what is a tax provision account

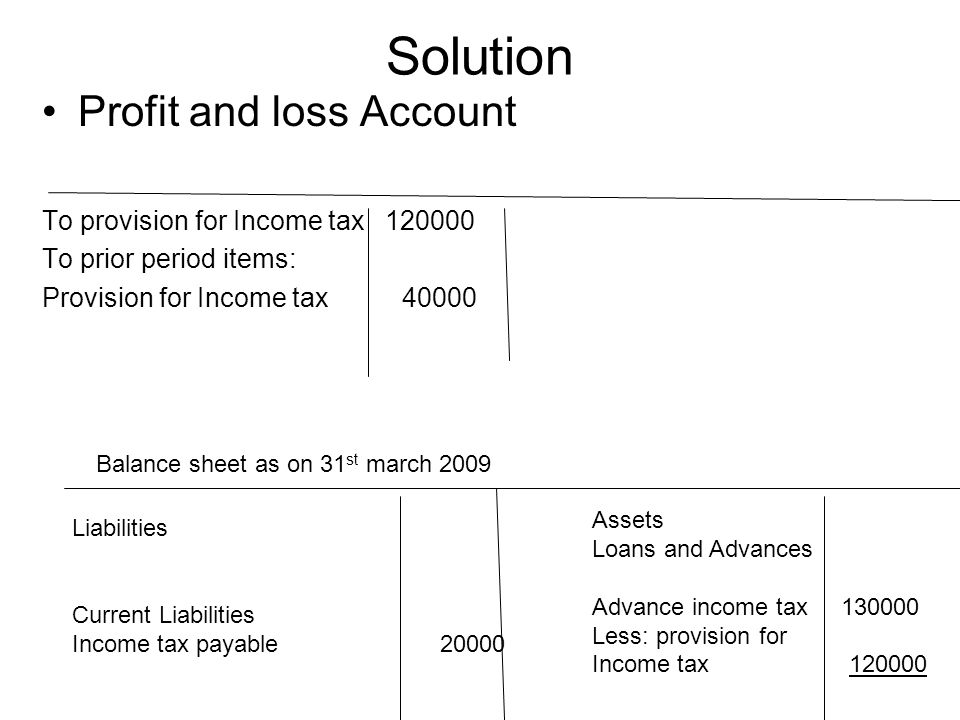

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. As current year tax expense is 21000 the total combined income tax provision of 37800 is.

What Is Tax Provisioning How To Calculate It Mosaic

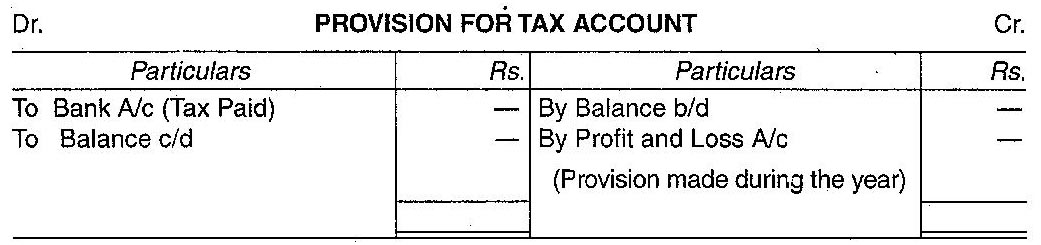

The provision in accounting means that amount which is charged against Profit or loss account Income statement for some uncertain.

. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. What Are Tax Provisions.

In order to calculate the tax amount owing a business needs to. In financial accounting under International Financial Reporting Standards IFRS a provision is an account that records a present liability. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

Multiply the remaining figure with the current federal tax rate to get your current tax expense for income provision. The overall formula for current tax. Other types of provisions a business typically accounts for.

If you are a Company transfer the Income Tax Provision FY17 to ATO - Income Tax Account. By their very nature. Tax provisions are an amount set aside specifically to pay a companys income taxes.

Under Provision of Income Tax. For the accounting year ending on December 31 st 2018. Consider applicable tax rates We recommend consulting an accountant for this.

The provision in accounting refers to an amount or obligation set aside by the business for present and future obligations. What is a tax provision. If you are a Sole Trader debit the equity account and credit ATO - Income Tax Account.

The amount of this provision is. This is the amount of income taxes payable or receivable for the current year as determined by applying the provisions of tax law to taxable. The provision for tax is based on profits in entitys income statement and reasons why it is a provision and not a liability.

Thus from the above Statement of Calculation of Profit before taxes 70000 is the profit before tax of the company A ltd. Tax provision is the estimated amount of income tax that a company is legally expected to pay the current year. Tax brackets can be more confusing than youd think.

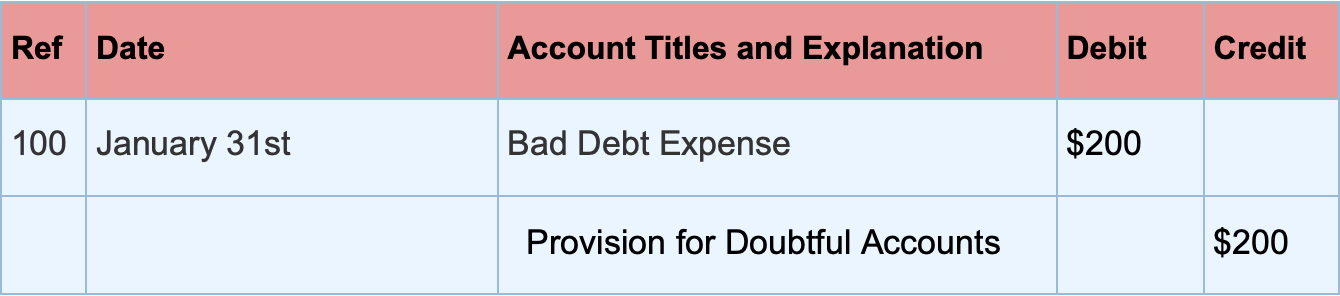

The provision of income tax is defined as the estimated amount that a business or an individual taxpayer expects to pay in terms of income taxes in the given year. The book tax expense is a function of book net income multiplied by the tax rate. The recording of provisions occurs when a company files an expense in the income statement and consequently records a liability on the balance sheet.

Estimate net income for the year. Current tax expense or benefit. Entity can have accounting policies and estimation process differ.

The Provision in Accounting Meaning. VAT Provision- tax becomes due or claimable only when you receive or make the payment. Under Provision of Income Tax merely implies that the organization had a lower Income Tax Expense projection for the current year and they ended.

What is Provision in accounting. The amount of this provision is. The amount of this provision is.

Unsourced material may be challenged and removed. Apply the current tax rate. When you process the sale or purchase the system needs a holding account to accumulate the.

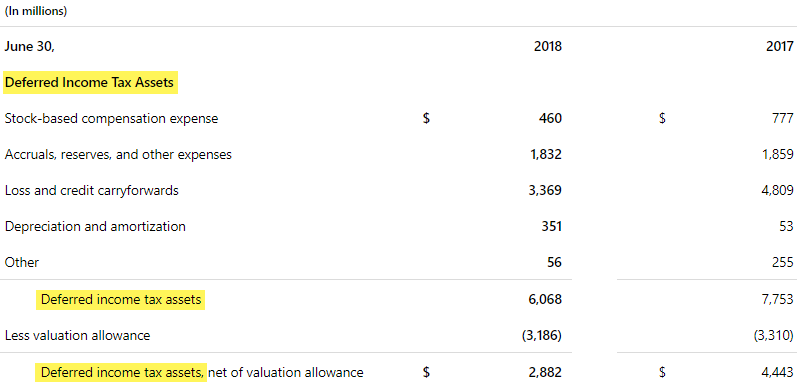

Deferred Tax Asset Journal Entry How To Recognize

Mapping Data In Tax Account Rollforward Data Forms

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Provision Expense Types Recognition Examples Journal Entries And More Wikiaccounting

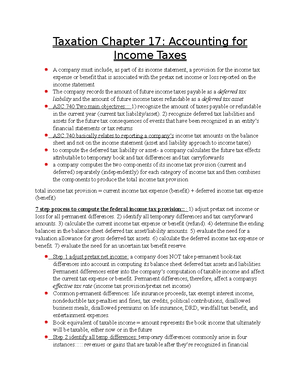

Chapter 17 Accounting For Income Taxes Taxation Chapter 17 Accounting For Income Taxes A Company Studocu

Accounting Treatment Of Provision For Income Tax Accounting Education

Deferred Tax Asset Journal Entry How To Recognize

Tei Introduction To Financial Reporting For Taxes Ppt Download

What Is A Tax Provision And How Can You Calculate It Upwork

How Would You Treat The Following Items In The Cash Flow Statement I Proposed Dividend Ii Provision For Taxation Iii Profit Or Loss On Sale Of Fixed Assets Owlgen

Provision Plc Cpa Firm We Build Tax And Wealth Strategies

Cuna Ccul Issue Action Alert On Irs Tax Reporting Provisions Carolinas Credit Union League

What Are The Largest Tax Expenditures Tax Policy Center

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Cbse Class 12 Concept Of Provision Of Tax In Hindi Offered By Unacademy

Provision For Income Tax Definition Formula Calculation Examples